🗓️ Posted on May 23, 2025

✍️ By Akshay

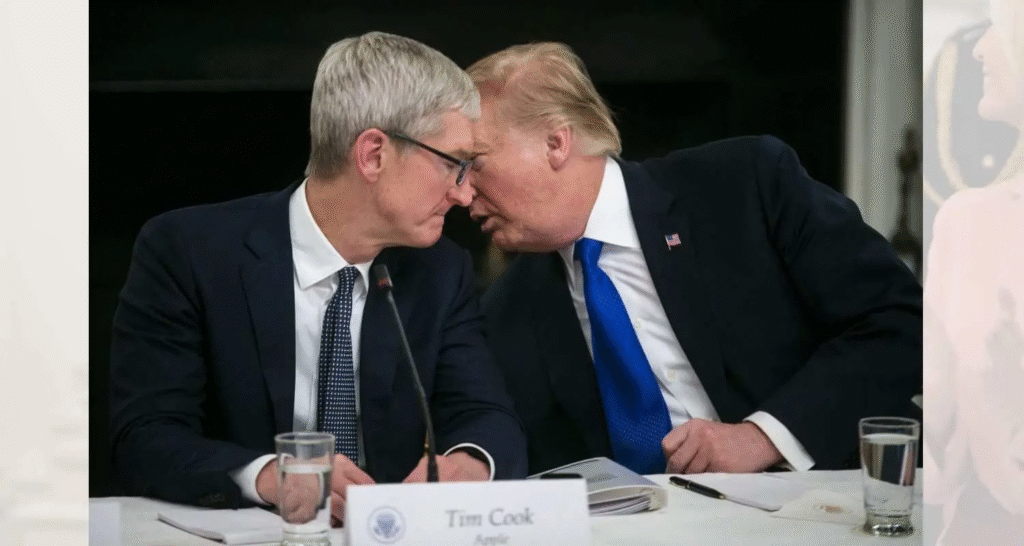

Trump’s Message to Apple: Don’t Shift iPhone Manufacturing to India or Face a 25% Tariff

In a fiery statement that’s making waves in the global tech and trade community, former U.S. President Donald Trump has issued a stern warning to Apple: continue manufacturing in the U.S., or face steep import tariffs. Specifically, Trump threatened a 25% tariff on iPhones and other Apple products if the company shifts its production to India or any other foreign location.

This development is not just a jab at Apple, but a reflection of Trump’s long-standing economic nationalism and his “America First” ideology. It also adds new fuel to the growing debate around global supply chains, corporate responsibility, and the geopolitics of tech.

Speaking during a political event, Trump criticized Apple’s reported plans to expand its iPhone manufacturing operations in India. According to him, American companies—especially tech giants like Apple—should prioritize domestic production and job creation over cheaper labor costs abroad.

“If Apple wants to move their production to India, that’s fine—but they should pay a 25% tariff when they bring those iPhones back into the United States,” Trump said.

It’s not the first time Trump has taken aim at Apple. During his presidency, he frequently urged U.S. firms to return manufacturing jobs to American soil, citing national pride and economic security as key reasons.

India has been actively courting global tech manufacturers through its “Make in India” initiative, offering incentives and subsidies to companies willing to set up local factories. Apple has already started assembling some of its models, like the iPhone 13 and SE, in India through its manufacturing partners Foxconn and Wistron.

Shifting production to India helps Apple in several ways:

- Lower labor costs

- Avoidance of tariffs on Chinese goods

- Access to one of the world’s fastest-growing smartphone markets

But Trump’s warning could complicate things. If Apple proceeds, it may face increased costs when importing iPhones back into the U.S., affecting pricing, supply chains, and possibly even consumer sentiment.

From a business perspective, Apple finds itself caught in the middle of two powerful forces. On one hand, the company wants to diversify its manufacturing footprint and reduce its dependence on China. On the other hand, political pressure from the U.S.—especially if Trump regains influence—could make foreign manufacturing a costlier proposition.

For consumers, this could translate into higher prices if tariffs are imposed. A 25% import tax is no small matter. It could push the price of iPhones and other Apple devices even higher, particularly in the U.S. market, where demand for the latest models remains strong despite rising costs.

This isn’t just about Apple or India—it’s about the future of global manufacturing. As geopolitical tensions rise and countries push for self-reliance, companies like Apple are finding it increasingly difficult to operate without facing political backlash.

Trump’s rhetoric taps into a growing sentiment that globalization should be reined in, especially when it affects domestic jobs. Whether or not Apple will bow to this pressure remains to be seen, but the tech world is watching closely.

Apple is at a crossroads. As the company looks to India to fuel its next phase of growth, it must also navigate the choppy waters of U.S. politics. With Trump putting tariffs back on the table, the debate over where our tech is made—and who benefits from it—has become more urgent than ever. Only time will tell whether Apple sticks to its global strategy or makes concessions to avoid a costly trade war. One thing is clear: the decisions made in boardrooms today will shape the tech landscape for years to come.