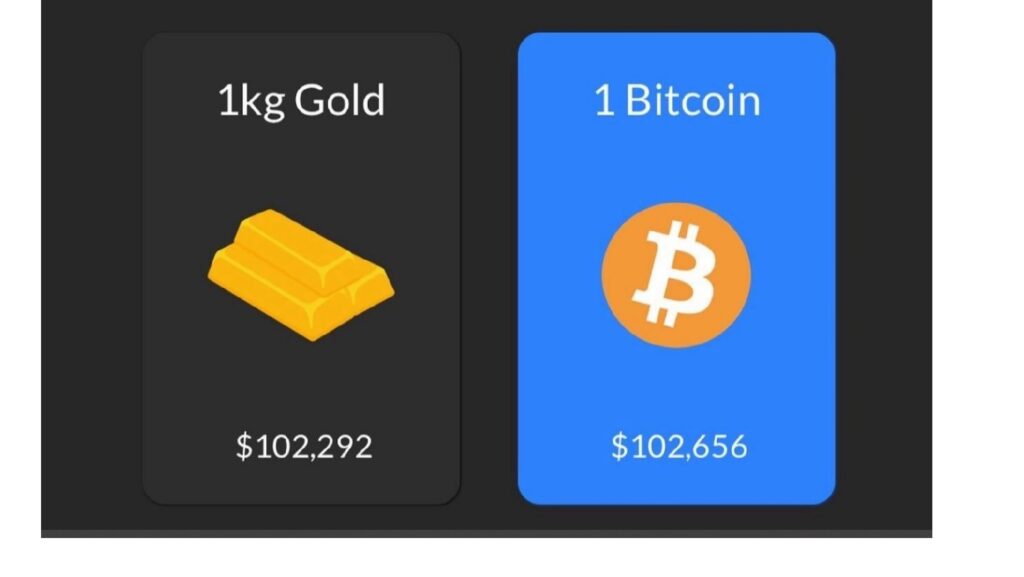

In a world increasingly driven by digital transformation and financial uncertainty, two assets continue to spark debates among investors: gold and Bitcoin. As of May 2025, the prices of these two iconic assets are neck and neck: 1 kilogram of gold is priced at approximately $102,292, while 1 Bitcoin is trading around $102,656.

This unexpected price parity has reignited the classic debate — which is the better store of value?

Let’s dive into the history, current status, and future outlook of both gold and Bitcoin to help you decide which one might be the right investment for the years ahead.

📈 Price Comparison Since 2015: Gold vs Bitcoin

Gold Price Trend (2015–2025)

Gold has long been considered a safe-haven asset. Here’s how its price has evolved over the past decade:

2015: $36,000 per kg ($1,120 per ounce)

2018: ~$41,000 per kg

2020: ~$55,000 per kg during COVID-19 uncertainty

2022: ~$61,000 per kg due to inflation fears

2024: ~$96,000 per kg

2025: ~$102,292 per kg

Over 10 years, gold has appreciated by nearly 184%, showing slow but steady growth.

Bitcoin Price Trend (2015–2025)

Bitcoin, the first decentralized cryptocurrency, has been far more volatile:

2015: ~$300

2017: ~$19,000 (bull run)

2018: ~$3,500 (crash)

2020: ~$10,000

2021: ~$64,000 (peak)

2022: ~$20,000 (bear market)

2024: ~$70,000

2025: ~$102,656

In a span of 10 years, Bitcoin has appreciated by over 34,000%, though with sharp corrections in between.

💡 Key Differences

Feature Gold Bitcoin

Nature Physical asset Digital asset

Volatility Low High

Liquidity High High

Regulation Well-regulated globally Still evolving

Adoption Universal (jewelry, finance) Growing (tech, finance)

Scarcity Finite (approx. 197k tons) Fixed (21 million BTC)

🔮 Future Outlook: 2025–2040 Projections

Gold Price Forecast

Gold’s long-term value is likely to grow steadily as it remains a hedge against inflation, currency devaluation, and geopolitical instability.

2030 Projection: $140,000–$160,000 per kg

2040 Projection: $190,000–$220,000 per kg

Expected CAGR (Compound Annual Growth Rate): 3%–4%

Bitcoin Price Forecast

Bitcoin’s growth is harder to predict due to its volatility and regulatory uncertainties, but with increasing institutional adoption and limited supply, the outlook remains optimistic.

2030 Projection: $250,000–$500,000

2040 Projection: $1 million or more per BTC (under bullish scenarios)

Expected CAGR: 15%–25% (in optimistic projections), but could vary significantly

🏦 Use Cases and Adoption

Gold

Used in jewelry, electronics, and central bank reserves

Recognized globally as a reliable store of value

Bitcoin

Increasingly used for cross-border transactions

Accepted by merchants, fintech platforms, and even national economies (e.g., El Salvador)

Seen as “digital gold” by younger investors

🧠 Expert Opinions

Warren Buffett: Still skeptical of Bitcoin, preferring gold and productive assets.

Cathie Wood (ARK Invest): Bullish on Bitcoin, projecting $ 1 M+ by 2030.

Ray Dalio suggests a balanced portfolio including both gold and digital assets.

🔍 Should You Invest in Gold or Bitcoin in 2025?

✅ Choose Gold If:

You prefer low-risk, long-term capital preservation

You’re building a diversified retirement portfolio

You value historical trust and regulatory clarity

✅ Choose Bitcoin If:

You’re comfortable with high volatility

You’re aiming for high long-term returns

You believe in digital transformation and decentralization

📌 Final Thoughts

As of 2025, gold and Bitcoin are nearly tied in value, but their paths to this point couldn’t be more different. Gold represents legacy stability; Bitcoin represents digital innovation. Both can be placed in a well-balanced portfolio, depending on your risk tolerance, investment horizon, and financial goals.

One thing is certain — the financial world is changing, and understanding these assets is crucial for making informed investment decisions.